Maximum profits at minimum costs.

The types of issues addressed by the platform.

The ways to recruit qualified employees to work on price formation.

Exclusion of the human factor in the pricing policy.

Minimization of the turnover of liquid lots.

The ways to adjust apartments prices, when to do it and the percentage of price adjustment.

Products of DyVa

Analysis of the current prices for new housing developments in the city

Conjoint-analysis-based evaluation of the margin for each apartment

A selection of relevant competitors is offered

The price of each lot for the market is generated on an individual basis

A unique algorithm groups apartments based on geometric parameters

A chequerwork of apartments is generated

The supply and demand of housing developments is analyzed

Assistance in keeping up the pace of the sales plan

The turnover of apartments is monitored

Adjustments in apartment prices are offered based on residential compound product content

Surplus profit amounts

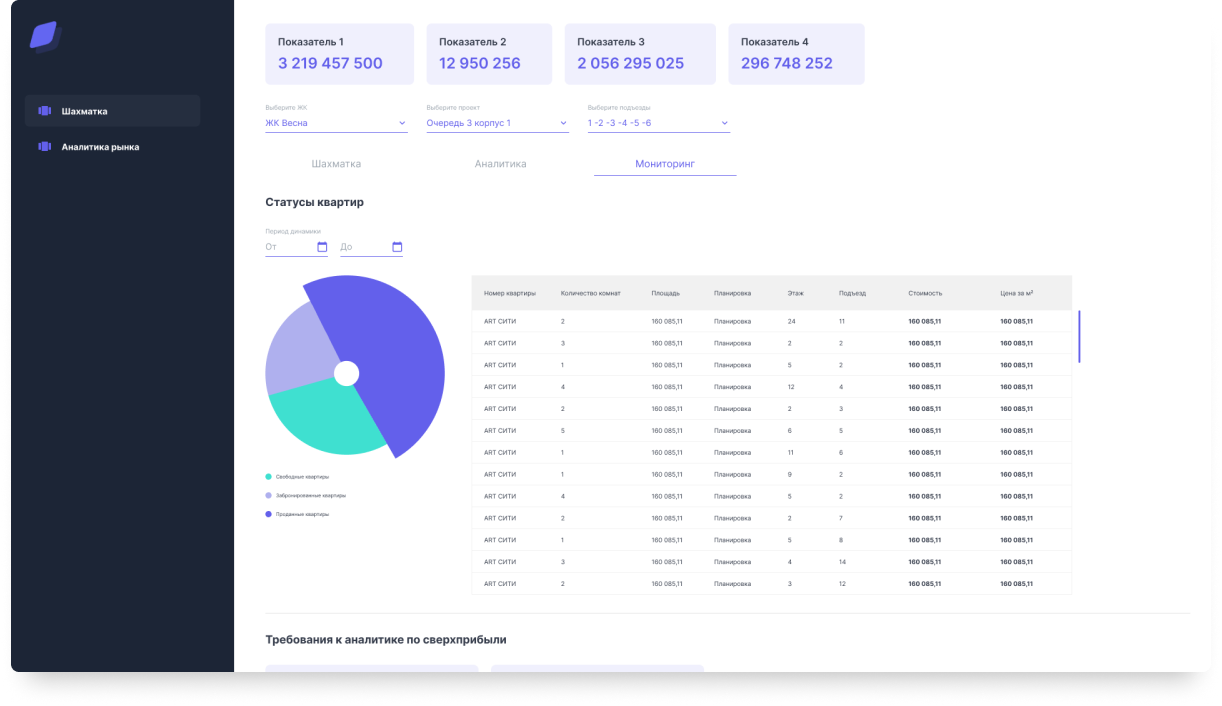

Illustrative dashboards are available for tracking dynamic pricing

Average prices

Turnover of lots

Analysis of prices and exposure of lots in terms of bedrooms and room layouts

Convenient tables are offered for better understanding of the current situation on the market of new housing developments

Comparison of your residential compounds and those of your competitors

Results

3

Objects have been integrated

Goal: come up with the first price while using dynamic pricing at the initial stage of building commissioning.

Problem: the building comes with unique features. Because of that, the developer does not know what prices to offer on the market relative to competitors. Nor can the developer decide on the course of price increases.

The steps taken:

The steps taken:

- Following an analysis of the entire market of new housing developments in Kazan and the first price set by the developer, a decision was made to hike up the prices of the liquid lots by five percent while cutting down the prices of the illiquid lots by five percent as well;

- Over fourteen months, the prices for the illiquid lots and the liquid ones were increased on a regular basis.

- Apartment sales in the building became as predictable as possible;

- By now, six percent of surplus profits have been made off of the illiquid lots;

- The price increases made in a correct and accurate manner ensured demand for all the types of apartments on offer without any of the types of apartments stagnating.

Goal: integration of dynamic pricing in the middle of a construction project.

Problem: the period of sales projected for the building is 1.5 years. Three months into apartment sales, only forty percent of apartments had been sold with surplus profits of just 2.8 percent.

The steps taken:

The steps taken:

- lot turnover analysis;

- the prices for the best-selling types of room layouts increased;

- redistribution of demand toward the less liquid lots.

- the actual sales rate met the planned one;

- demand was balanced between the liquid lots and the illiquid ones;

- surplus profits after seven months of sales added up to seven percent.

Goal: integration of dynamic pricing at the beginning of a project without the first price.

Problem: the initial price of the lots was undervalued as the pricing was based on irrelevant competitors. That led to a large number of sales in the early stages.

The steps taken:

The steps taken:

- the first price was corrected;

- the prices for the best-selling room layouts were increased on a systemic basis;

- the lots were opened alternately at the request of the developer.

- The actual sales rate is still slightly higher than planned;

- A more unique way of control over closed and open lots maintains the required level of exposure;

- The surplus profit for four months amounted to more than ten percent.

Interested in the system?

Please fill in the contact details and we will contact you as soon as possible

+7 (917) 276-10-51

dyva.dco@gmail.com

Legal address: Republic of Tatarstan,

Kazan, 13 Sibirsky trakt,

room 1410, room No. 1, office 6

ITN: 1686036105

Kazan, 13 Sibirsky trakt,

room 1410, room No. 1, office 6

ITN: 1686036105

Submit your application

Please fill in the contact details

and we will contact you as soon as possible

and we will contact you as soon as possible